About Pei

Pei is a real estate investment alternative, through which investors participate in a diversified portfolio of income-generating assets through Equity Securities traded on the Colombian Stock Exchange. BRC Standard & Poor´s awarded these Equity Securities its highest rating: i-AAA.

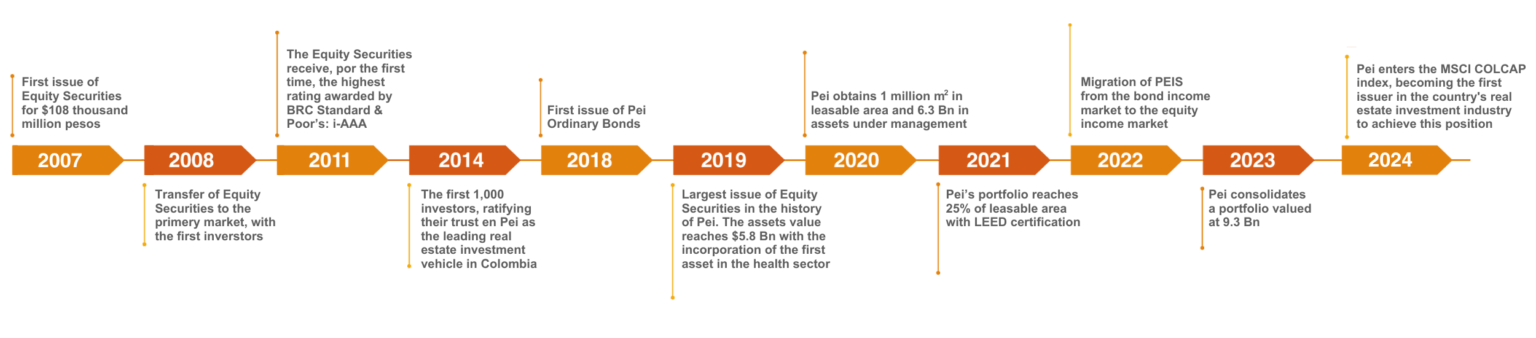

Track Record

Since 2007, Pei has offered eleven tranches of Equity Securities to the market, consolidating over 6,400 investors. Pei offers to institutional and non-institutional investors a long-term income-generating investment alternative with distinctive features within the market, such as liquidity and low volatility.

What does Pei invest in?

Pei invests in different real estate assets categories in Colombia, with income generation and appreciation potential, seeking a continued diversification per type of asset, tenant, and geographic location.

- Corporate

- Commercial

- Logistics and industrial

- Specialized

Related Entities

Real Estate Manager

Expert manager and administrator of real estate investment vehicles, seeking to optimize the portfolio assets’ value in order to obtain attractive returns that are transferable to investors.

Decision Making

Body responsible for making the main decisions on acquisitions, indebtedness, and issuances and, generally monitoring the vehicle’s performance. PEI’s Advisory Committee has a mixed composition, which is mostly independent.

Management Agent

Entity acting as spokesperson and legal representative for the PEI trust. It is also the issuer of the TEIS (Estrategias Inmobiliarias Securities) and the vehicle’s management agent.

Investors Legal Representative

Entity acting as the investors’ legal representative, responsible for carrying out any and all acts necessary to assert the Investors’ common rights and interests.

Legal Advice

Legal advisor for Pei. Provides permanent advice on the legal matters concerning the Trust.

Surveillance entity

Government entity in charge of monitoring the financial and stock market systems where Pei operates.

Legal Representative of the Bondholders

Entity in charge of carrying out all the acts of administration and conservation that are necessary for the exercise of the rights and the defense of the common interests of the Bondholders.

Corporate Governance

In order to deepen its Corporate Governance best practices, the Real Estate Manager has worked on the implementation of recommendations related to the risk management and information management.

Country Code

Document aimed at raising the Corporate Governance standards to offer, among others, a greater value, strengthen the risks’ management and control, and facilitate the issuers obtainment of better financing conditions as a result of the creditors’ and investors’ better perception.