Colombian leading real estate investment vehicle

Investment in Pei

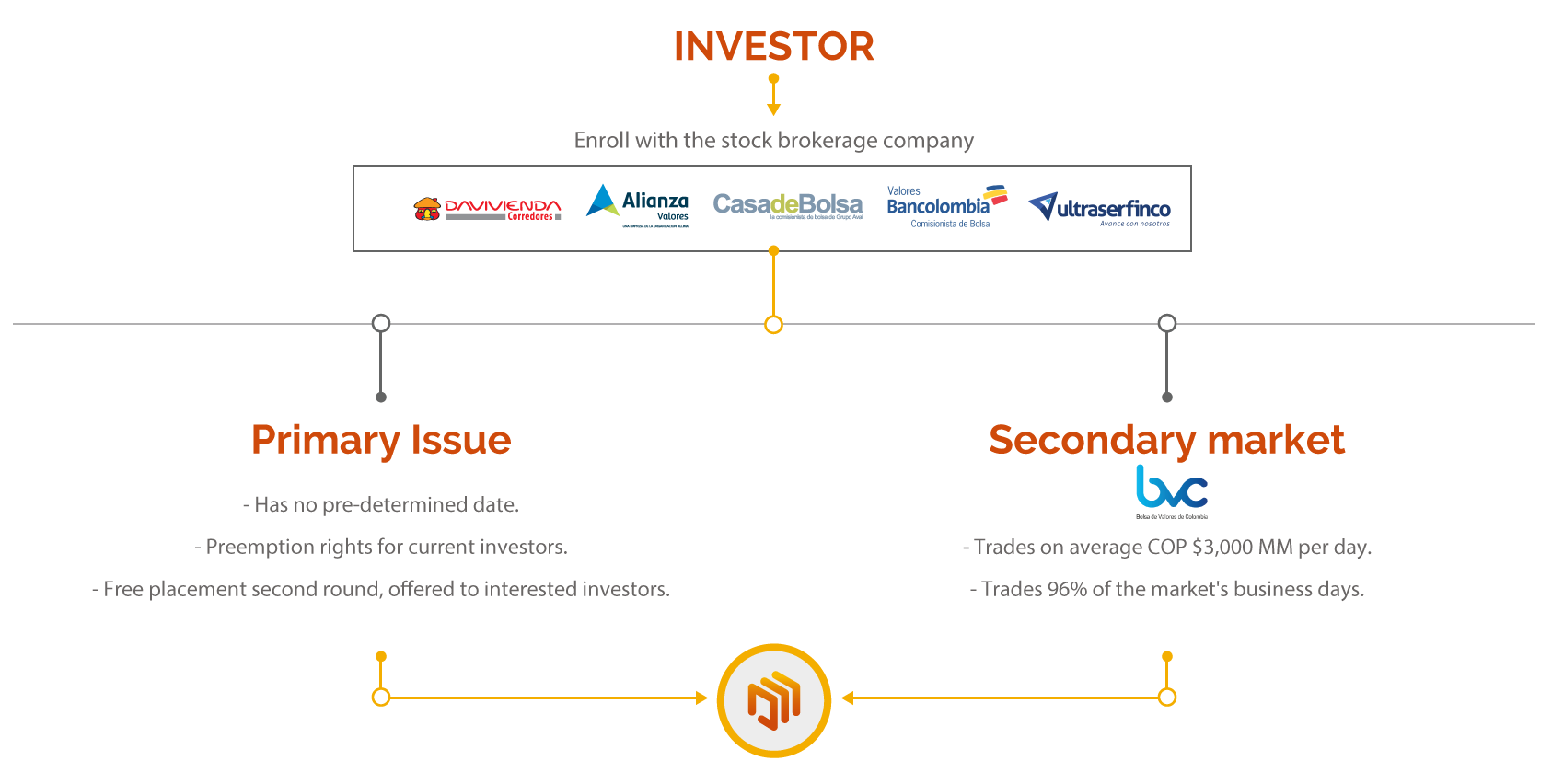

How to Invest in Pei?

Any individual, business, or company interested in investing in Pei, may do so by purchasing TEIS Equity Securities. TEIS may be acquired in a primary issue or the secondary market, in both cases through a Stock Brokerage Firm.

Primary Issue

Primary issues take place whenever the vehicle issues new securities. The issue has a first round where current investors may exercise their preemption rights and maintain their interest percentage, and a second round, targeting the general market, where current and new investors may access the remainder of the first round and acquire as many TEIS as possible, considering the relevant remainder thereof.

Secondary Market

A current or new investor may acquire Pei’s Equity Securities through the secondary market, as they are daily traded on the Colombian Stock Exchange. Investors interested in acquiring PEI Securities must do so through a Stock Brokerage Firm.

Why invest in Pei?

Pei’s investors participate in a long-term income generating diversified portfolio. Investments in the vehicle offer an attractive return with low volatility and high liquidity, as a result of the daily traded volumes on the Colombian Stock Exchange.

Leadership

Leader in the real estate investment vehicles sector in Colombia, with a significant size in Latin America.

Liquidity

The high volume traded in the secondary market, generates permanent liquidity to this real estate investment.

Profitability

Pei offers its investors, under a long-term proposition, an attractive return with low volatility.

Professional Management

Pei Asset Management is an outstanding qualified manager with high corporate governance standards.

Portfolio

A hardly replicable real estate assets portfolio, categorized per type of asset, geographic location, and tenant.

Solidity

Throughout the 13-year history of the vehicle, PEI has grown steadily and achieved a solid financial performance.

What does Pei invest in?

Pei invests in commercial real estate assets categories with income generation and appreciation potential, seeking a continued diversification per type of asset, tenant, and geographic location.

- Business centers

- Corporate offices

- Shopping centers

- Hypermarkets

- Commercial premises

- Logistics centers

- Stand-alone warehouses

- Educational sites

- Hotels

- Health sector sites

Coverage Analysis

Investor Relations

The Investor Relations Management Office’s responsibility is to support and facilitate the vehicle’s real estate manager interaction with investors, Stock Brokerage Firms, the Investors Legal Representative, and the Management Agent.

Equity Securities

Investors acquiring TEIS securities, own a proportional interest in the Pei Trust which, in turn, owns the real estate assets.

TEIS are registered with the Registro Nacional de Valores y Emisores de la Superintendencia Financiera de Colombia [Financial Superintendency of Colombia’s Securities and Issuers National Registry] and traded on the Colombian Stock Exchange.

Since 2011, BRC Standard & Poor’s has awarded the TEIS its highest rating for equity securities: i-AAA.

Ordinary Bonds

In August 2018, Pei made its first issue of ordinary bonds, becoming the first real estate vehicle in Colombia to make such an issue within the stock market.

The resources from the bonds are entirely used to substitute the liabilities, as part of a financing sources’ diversification strategy, which also seeks to optimize the vehicle’s debt service.