Bogotá, November 7, 2019. Pei, Colombia’s leading real estate investment vehicle, with over COP 6,0 billion in real estate assets under management, made its second issue of ordinary bonds worth five hundred thousand million pesos (COP 500,000,000,000). With this issue, Pei completes a total of 1 billion pesos in ordinary bonds placed.

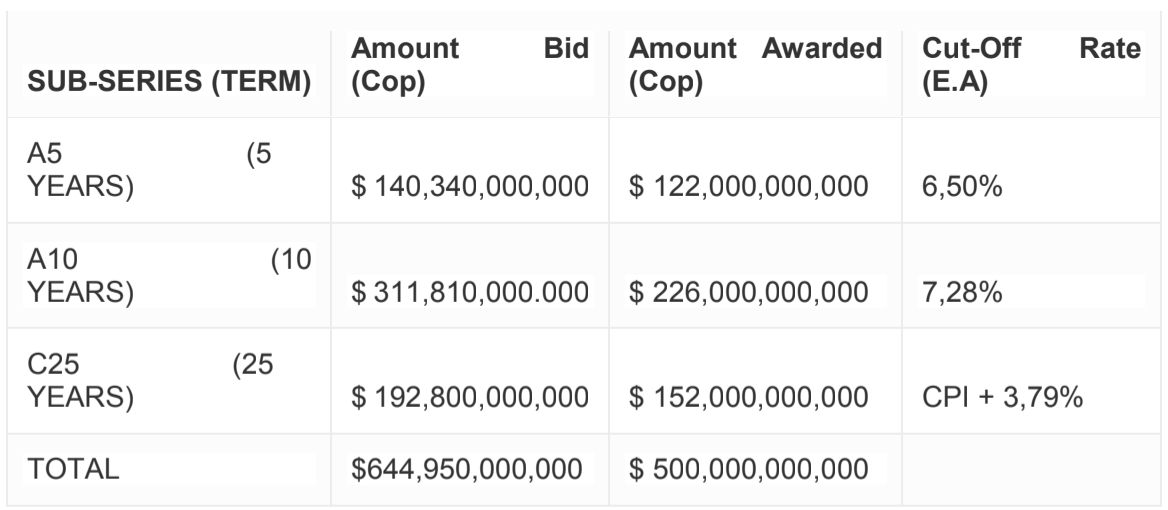

The issue, offered in three sub-series –two at a fixed rate, with 5 and 10-years terms, and the other one at the CPI, with a 25-years term–, obtained excellent results, receiving bids for over six hundred and forty-four thousand, nine hundred and fifty million pesos (COP 644,950,000,000), which exceeded 1,61 times the amount offered.

The net resources of this second issue of ordinary bonds will be entirely allocated to substitute the financial bank debt, as part of the investment vehicle’s stategy to diversify its financing sources and optimize its capital structure strategy.

“Obtaining this level of bids in our second issue of ordinary bonds, particularly by investors who are also titleholders of Pei’s Equity Securities, signals the growing confidence of the vehicle’s management and results in the market”, stated Jairo Alberto Corrales, PEI Asset Management’s President. PEI Asset Management is Pei’s real estate manager.

With this second issue, Pei continued with its Ordinary Bonds Issuance and Placement Program, following the Financial Superintendency of Colombia’s authorization to extend its total authorized amount to 1,5 billion pesos.

Corredores Davivienda served as Leading Placement Agent for the second issue of Pei’s ordinary bonds. Valores Bancolombia, Alianza Valores, Ultraserfinco, Casa de Bolsa, and Scotiabank Securities served as placement agents. Risk rating agency BRC Standard & Poor’s, rated Pei’s Ordinary Bonds as AA+. The results of the award under a Dutch auction were the following: